Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Net long

Inside Day/Outside Day:Outside

Location of price relative to market profile:

Notable overnight futures markets changes:

Up: NKD (Nikkei), NG (Nat Gas), Indexes

Down:SI (Silver), CL (Crude Oil), GC (Gold), ZW (Wheat), PL (Platinum), ZC (Corn)

News for the day:

NONE

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

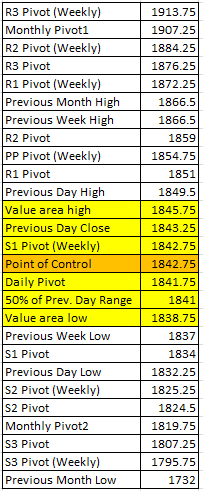

Projected ES price action for the day:As the saying goes, never step in the way of a moving train. When a market is trending upwards, traders will buy on any dips as they see value at lower prices with the expectation that the market will retrace to the highs. Despite the escalating tension in the Ukraine, the bulls were at it again during the globex session and recooped all of the selling from Monday. When watching the market internals during yesterday's trading session, the conditions were not as bearish as the percentage change would indicate. For example, the AD lines opened at around -1200 and yet by the afternoon, it had moved up to -500 (+700). On truly bearish days, the AD line would open below -1000 and stay pegged around the level for the duration of the day. Since the S&P is back near the all-time highs the natural level to watch is 1866.5 when the markets open for trading. Intraday edge to the bulls.

ES Daily Trend: Bullish

ES Weekly Trend: Strongly Bullish

ES Monthly Trend: Strongly Bullish

No comments:

Post a Comment