Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change: Neutral

Inside Day/Outside Day:Inside

Location of price relative to market profile: Near value area high

Notable overnight futures markets changes:

Up: ZS (Soybeans), ZM (Soybean Meal), KC (Coffee), ZL (Soybean Oil), NKD (Nikkei)

Down: ZO (Oats), GC (Gold), HG (Copper)

News for the day:

Petroleum Status Report: 10:30a

FOMC Minutes: 2:00p

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

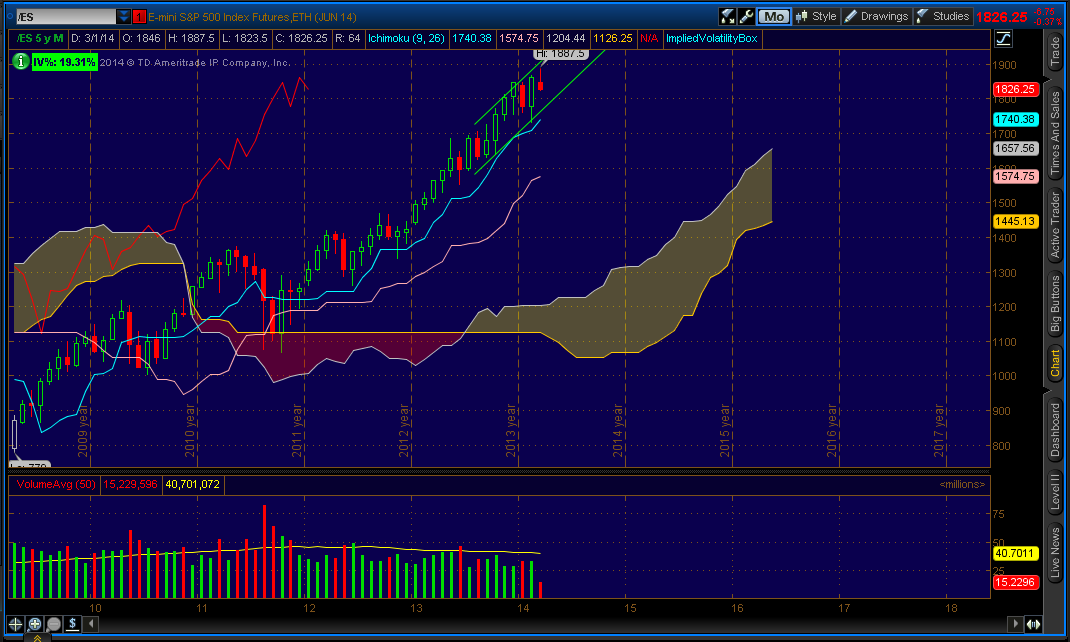

Projected ES price action for the day: The way prices flow on the S&P can be likened to magnets. They are attracted to high volume levels and filling gaps. High volume levels are significant because this is where large traders had done business in the past and there is a high probability that buyers and sellers will protect the level with large size. The ES is once again trading in the high volume range from 1865-1880 after breaking through the downward channel on the hourly chart yesterday. Any price action in the zone is likely to bring in more two-sided trade as both bulls and bears have been active at these levels. With prices near the all-time highs, intraday edge is neutral/bullish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment