Daily Outlook

Prior Day Market Sentiment: Bearish

Overnight Inventory Change:Net short

Inside Day/Outside Day:Inside

Location of price relative to market profile: Below value area

Notable overnight futures markets changes:

Up: ZM (Soybean Meal)

Down:SI (Silver), NG (Nat Gas), NKD (Nikkei), HG (Copper), KC (Coffee), CC (Cocoa), PA (Palladium), GC (Gold), ZW (Wheat), ZC (Corn), PL (Platinum), CT (Cotton)

News for the day:

Jobless Claims: 8:30a

Philadelphia Fed Survey: 10:00a

Existing Home Sales: 10:00a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

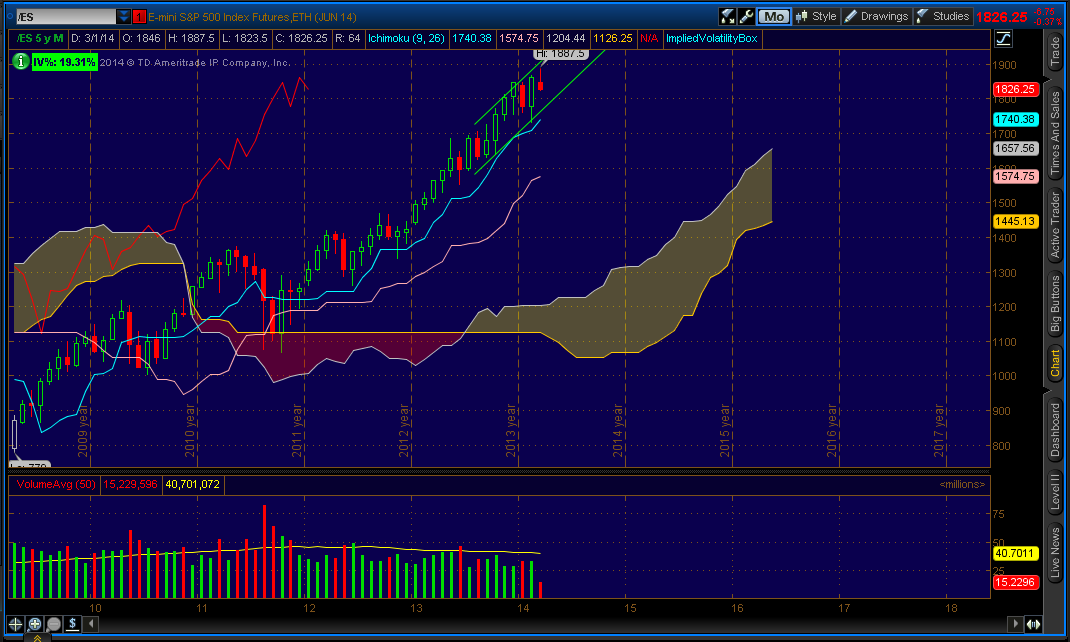

Projected ES price action for the day:Trading on the S&P futures can be likened to a tug-of-war between buyers and sellers. Each side tries to wrestle the price action in a back and forth seesaw battle to drive prices in the intended direction of their trades. At any given time, either side could find themselves on the short end of the stick. After yesterday's FOMC news that saw the Fed reduce bond purchasing by $10 billion the markets sold off and created a wide range red candlestick. Volatility has increased recently as the bears are attempting to build momentum in pulling prices from the all-time highs. Typically when there is a trend reversal, the price activity is whippy and volume is spread out on the profile. The key level to watch today will be Wednesday's low of 1842. If there is a liquidation break at the open, then the higher probability is for a trending day lower. Intraday edge is bearish.

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Bullish

No comments:

Post a Comment