Daily Outlook

Prior Day Market Sentiment: Bullish

Overnight Inventory Change:Net short

Inside Day/Outside Day:Outside

Location of price relative to market profile: Below value area

Notable overnight futures markets changes:

Up: SI (Silver), KC (Coffee), SB (Sugar), OJ (Orange Juice), GC (Gold)

Down:NG (Nat Gas), NKD (Nikkei), RB (Heating Oil), CL (Crude Oil), 6A (Aussie Dollar), Indexes

News for the day:

Personal Income & Outlays: 8:30a

Employment Cost Index: 8:30a

Chicago PMI: 9:45a

Consumer Sentiment: 9:55a

*Red highlight means the news is a market moving event;

yellow highlight means the news merits attention

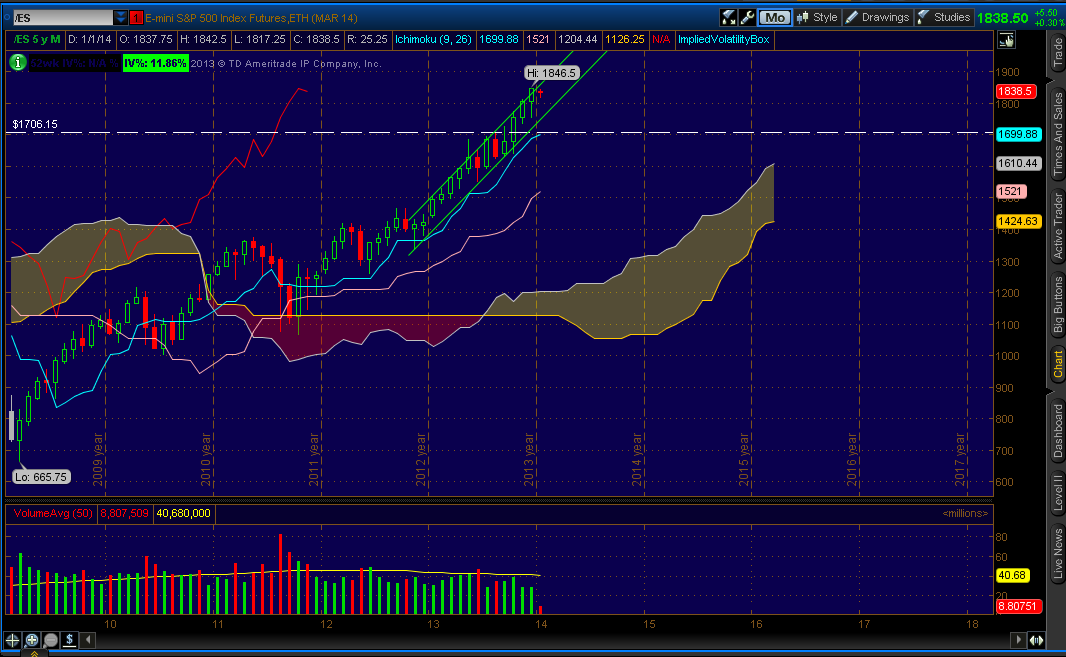

Projected ES price action for the day: The S&P recooped some of the selling from last week with all of the indexes up more than 1% yesterday. It marked the sixth straight day where the intraday trading range has eclipsed 10 handles (or points), a sign that volatility is back and traders are active. We saw a solid bounce with volume off the daily trendline and it will be noteworthy to see if the bullish momentum can be sustained. The ES has sold off during the premarket and the next level of support is the Jan. 29th low of 1764. There is also a VPOC to be filled at 1773.50 if there is buying at the open. At this point, though, the bears have got the edge.

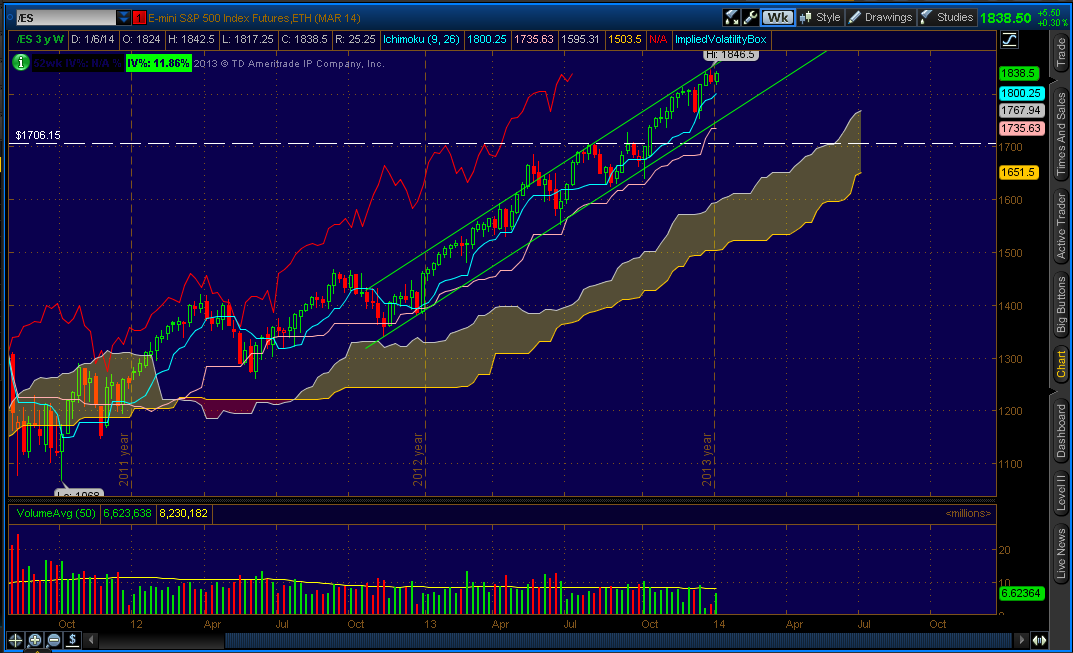

ES Daily Trend: Neutral/Bullish

ES Weekly Trend: Bullish

ES Monthly Trend: Strongly Bullish